Sub-Prime Credit

Whatever the reasons for a lower credit score, people with sub-prime credit realize that it can become a bit of a self-fulfilling prophecy. The higher interest rates and overall higher prices that people with sub-prime credit have to pay for select goods and services means less money available, increasing the likelihood that they will miss payments, which only serves to lower credit scores. While not everyone with sub-prime credit is struggling financially, it is a well-known way that those in lower income groups stay trapped in a cycle of financial struggle. Fortunately, there is a way out of this debt-and-bad credit cycle.

What is Sub-Prime Credit?

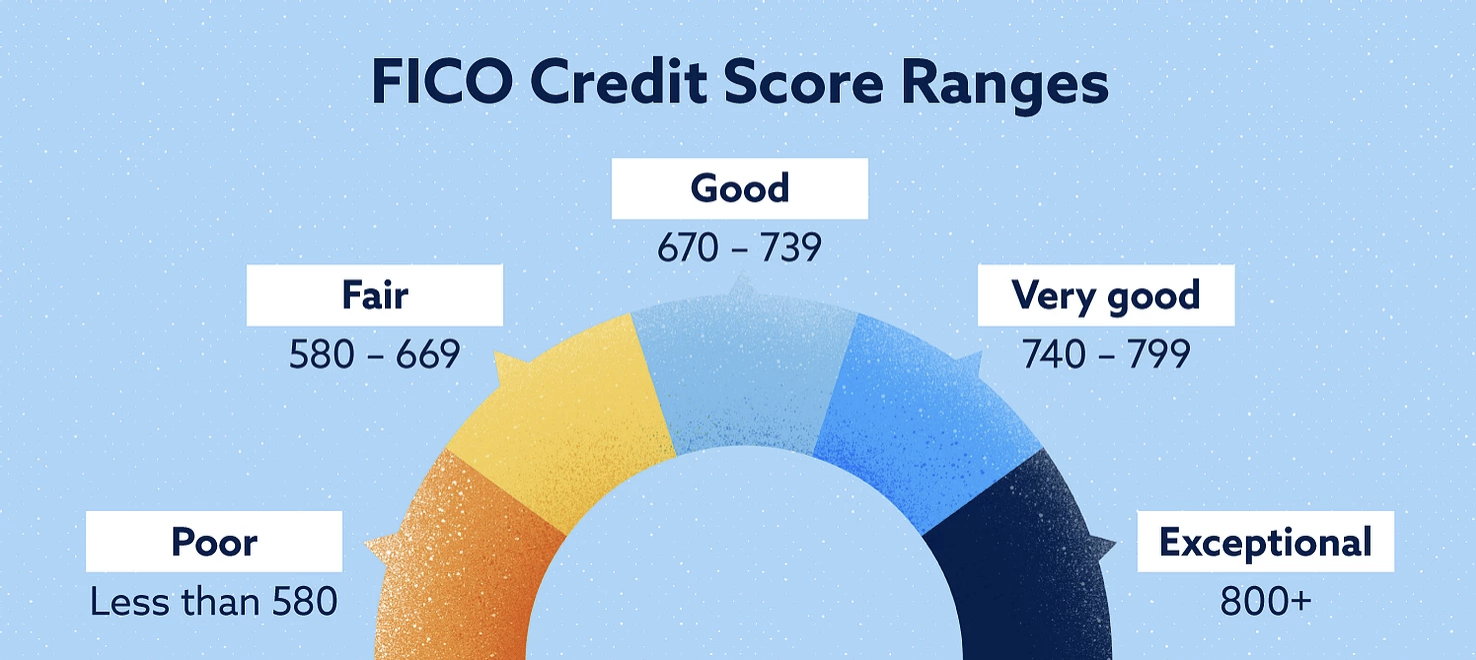

Sub-prime credit refers to people considered a higher risk for repayment than other borrowers. As a result, these borrowers are ineligible for the best “prime” interest rates. Sub-prime credit is subjective; since borrowers are ranked in terms of risk to the lender, there will always be people in the sub-prime category. Currently, about one-third of Americans fall into this category, though that percentage rises and falls along with some other economic factors.

The reason that sub-prime borrowers do not get the best interest rates is that they are considered higher-risk than prime borrowers. They are more likely to carry high balances on their available credit and a history of late payment or non-payment suggests that they are more likely to miss future payments. Combined, those factors suggest that sub-prime borrowers are at a higher risk of default, which means that lenders increase interest rates as a way to try to make up for this risk of default.

How Does Sub-Prime Credit Impact You?

From a lender’s perspective, these higher interest rates make sense. However, for borrowers struggling with debt and trying to establish better financial habits, being sub-prime means paying more for the same goods and services over time. For homes, this can mean 100s of 1000s more in interest over the life of the loan, 10s of 1000s in interest for automobile loans, and who knows how many 1000s for unsecured debt. It can also make people ineligible for certain types of loans, which can make buying a home or purchasing a reliable vehicle impossible.

Fixing Sub-Prime Credit

Many people erroneously believe that the only way to improve sub-prime credit is to slowly work their way through debt and rebuild a history of on-time payments. While those things are important, it is equally important to look at the entirety of your credit report. Approximately 80% of people have errors on their credit report. Fixing those errors and disputing negative information can result in immediate improvement to your credit score and these incremental increases can really help your journey back into prime credit territory. While the process may be daunting, Square One Credit can help.